As a revenue cycle leader delivering a positive financial experience to ensure patient loyalty and liabilities resolution across your revenue cycle is challenging. No two patient experiences or expectations are exactly alike.

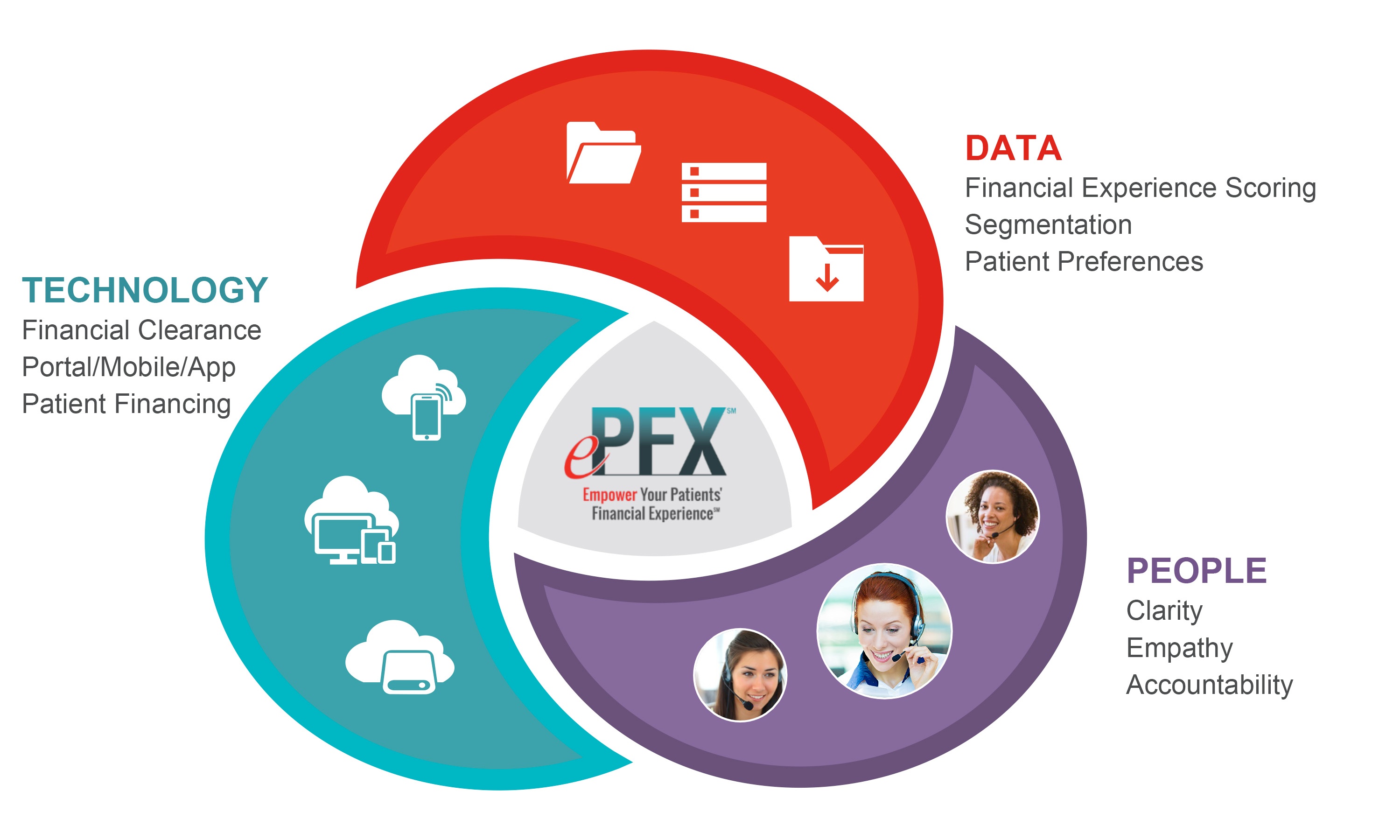

That’s why we pair our entire ePFX suite of patient liability resolution services, from self-service to financial clearance, patient access, early-out and bad debt recovery with world-class data integration tools, technologies and consultative professionals to help you leverage each patient engagement as an opportunity to optimize satisfaction, loyalty and revenue.

Let us help you improve your patient liabilities, drive real-time service recovery and directly and quantifiably empower your Patients’ Financial Experience from the first encounter to the last.

ePFXsolutions

ePFXsolutions

Our early-out account resolution teams go beyond collecting payments from patients. As certified and patient-focused representatives, we work as an extension of your revenue cycle business office, systems and policies. Providing payment plans and financial counseling early in account resolution and using expert scoring and segmentation of accounts help us maximize your overall patient liabilities collection.

Using advanced call-center technology and compassionate customer-service training, our team resolves any patient concerns and objections to paying the account balance. Measuring, predicting, and scoring across every engagement and medium ensures the highest standards of customer service are being met and we're empowering Patients' Financial Experience based on trust and compassion.

Avadyne's U.S.-based collection specialists are trained and certified through ACA, authorized to collect in 48 states and 100 percent healthcare-focused. Our advanced call-center technology and compassionate customer service training helps patients resolve concerns and objections to paying their account balance. We comply and adhere to FDCPA and FCRA standards.

A sophisticated screening process and predictive modeling allow us to focus on the best outcomes and cost savings during collections. Our refined methodology and seamless integration provide the highest compliance, performance and value.

We’re seasoned pros with the highest of standards in customer service and financial training. It’s just one of the reasons we’re named by Black Book as the #1 Self-Pay/Early Out company in the industry and ranked within the top 10 of the largest revenue-cycle management firms. As active members and popular speakers in the industry (HFMA, AAHAM, NAHAM, HIMSS and Becker’s) the Patient Financial Experience is our passion. Learn why.